League of cities: Cut current worker pensions?

By Ed MendelCalPensions.com

Reporter Ed Mendel covered the Capitol in Sacramento for nearly three decades, most recently for the San Diego Union-Tribune. More stories are at http://calpensions.com/ Posted 15 Aug 11

HEALDSBURG — A new League of California Cities pension reform plan proposes a “detailed legal review” of whether pensions promised current workers can be reduced, a cost-cutting move widely believed to be prohibited by court rulings.

A look at the legality of reducing pensions that current workers earn in the future, while protecting pension amounts already earned through years of service, is similar to a recommendation from the watchdog Little Hoover Commission in February.

“Pension sustainability cannot be fully achieved without addressing the benefits of both current and future employees,” said the League of California Cities plan issued late last month and distributed at a pension workshop here last week.

As pension costs soar, particularly in local government where most spending is on personnel, savings from clearly legal changes (mainly higher pension contributions from workers and lower pensions for new hires) are said to fall short.

“What I’m hearing is that there is no good solution,” Healdsburg Mayor Tom Chambers said last week at a pension workshop after being briefed on current cost-cutting options by officials from the league of cities and CalPERS.

“Rates are going to continue to go up to a point where for every person working for the city you are paying for another one that’s not,” said the mayor of the city with 11,000 residents on the Russian River in the Sonoma County wine country.

“What suffers then is the level of services, and that’s what’s really disconcerting,“ said the mayor. “I don’t know how you go forward with that.”

Bigger savings for government employers could come from reducing pensions that current workers earn in the future. It’s a cost-cutting option for the dwindling number of private-sector employers that offer pensions.

But for state and local government employers, many but not all believe that a series of court rulings mean pensions promised workers are, from the date of hire, “vested rights” under contract law that can only be cut if offset by a benefit of equal value.

The go-slow league of cities plan begins with five things that can be done by bargaining with unions, moves on to 15 things needed from the state and concludes with a third step that looks at cutting current worker pensions and a possible ballot measure.

The league of cities, spending $3 million on each campaign, got voter approval of two ballot measures aimed at protecting local funds from state raids: Proposition 1A in 2004 received 84 percent of the vote, Proposition 22 last November received 61 percent.

The pension reform plan said the league should work with unions and the Legislature and the governor to restructure the California Public Employees Retirement System to protect the “fiscal integrity” of cities and retirees.

“This could include jointly sponsoring an initiative if legislative change is insufficient,” said the plan.

Among the proposals: Restructure the CalPERS board to include more independent public members, preferably with financial expertise, to represent taxpayers. The board is currently dominated by labor representatives.

A statement in the plan that “the benefits of both current and future employees” must be addressed is followed with this proposal:

“After a detailed legal review and to the extent permitted by federal and state law, a well-designed state constitutional amendment is needed for prospective retirement formula reductions and incremental retirement age increases for current employees to guarantee their already accrued earned benefits, while making the plan sustainable, affordable and market competitive on a going-forward basis. The amendment should also include a risk-managed PERS defined contribution plan for public agencies.”

One of the 27 recommendations in the plan would authorize CalPERS to offer the option of a “hybrid” combining a “defined contribution” or 401(k)-style individual investment plan with a lower pension.

An official of the league told the workshop last week there has been no state action on pension reform, despite Gov. Brown’s 12-point pension reform proposal and an attempt by Senate Republicans to get pension reform in a budget deal on tax votes.

“Many think if it’s going to happen it will have to be a statewide ballot initiative,” the regional public affairs manager for the League of California Cities, Nancy Bennett, told the workshop.

“Lot of talk again,” she said, “nothing for this upcoming ballot, and partly because it costs about $3 million to run a successful campaign, and that’s a lot of money right now in the state’s economy.”

Bennett said polls this year by the Public Policy Institute of California and the Los Angeles Times show strong support for public pension reform.

“Who is going to spearhead this initiative campaign most likely is the big question,” she said.

A pension reform group led by Dan Pellissier is working on an initiative, not yet filed, that would cut the benefits of current state and local government workers by limiting employer contributions to their pensions and switch new hires to 401(k) plans.

A proposal by San Jose Mayor Chuck Reed, based on other court rulings, would use the declaration of a fiscal emergency and a local ballot measure to reduce pensions earned in the future by current workers in the two city-run plans.

San Diego Mayor Jerry Sanders and others are proposing a local initiative that would switch new city hires to a 401(k)-style plan and attempt to cut current worker benefits by putting a five-year cap on pay counted toward pensions.

The league of cities plan said near the end that “if the above reforms prove unfeasible or ineffective, consider a standard public employee pension system where one benefit level is offered to every employee” as an option to make CalPERS sustainable.

Critics say CalPERS-sponsored legislation, SB 400 in 1999, boosted Highway Patrol pensions by 50 percent, setting a new standard for local police and firefighter bargaining that resulted in “unsustainable” pensions.

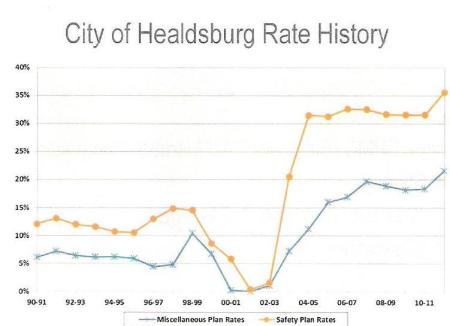

At the workshop, CalPERS actuary Barbara Ware said Healdsburg pension costs jumped sharply after 2002 because of a change in CalPERS “assumptions” (apparently due in part to a stock market dip) and higher pensions for police and firefighters.

CalPERS previously had dropped Healdsburg’s rates to near zero, a contribution “holiday” during a stock market boom given to many of the system’s 2,000 local plans. Ware said future contribution holidays are unlikely under new policy.

Healdsburg boosted pensions for “miscellaneous” or non-safety employees in 1998 and again in 2007. Ware said the rates (35 percent of safety pay and 22 percent of miscellaneous pay) will continue to rise as major investment losses in 2008 are phased in.

Healdsburg pays the employee’s pension contribution, 7 to 9 percent of pay, and counts that as salary used to set pension amounts. Ware said the city has the option of ending that — even switching to have employees pay part of the employer contribution.

Generally, said Ware, “From CalPERS’ point of view, if we get the money we don’t care where you get it from.”

No comments:

Post a Comment